The necessary path to a carbon-free economy will only be achievable with a fundamental transformation of essential sectors. Above all, there is a need to channel private capital into sustainable enterprises. The acceptance of this epoch-making project depends on the coherence of the legal framework to be created. So far, there are mainly regulations that can be summarized under the catchword “sustainable finance”, they concern shareholder governance, fund governance and product governance issues.

The aim of the Conference „Sustainable Finance in European Jurisdictions” was to investigate the implementation of this regulatory program from a comparative law perspective in order to uncover inconsistencies and, if necessary, to identify any need for action on the part of the European and the national legislators.

The conference was organized in a hybrid format at the Hungarian Academy of Sciences in Budapest and on Zoom.

The event was organized by the Ferenc Mádl Institute of Comparative Law, Justus Liebig University Giessen and Vienna University of Economics and Business (WU).

Summary of the conference

(by Björn Schneider)

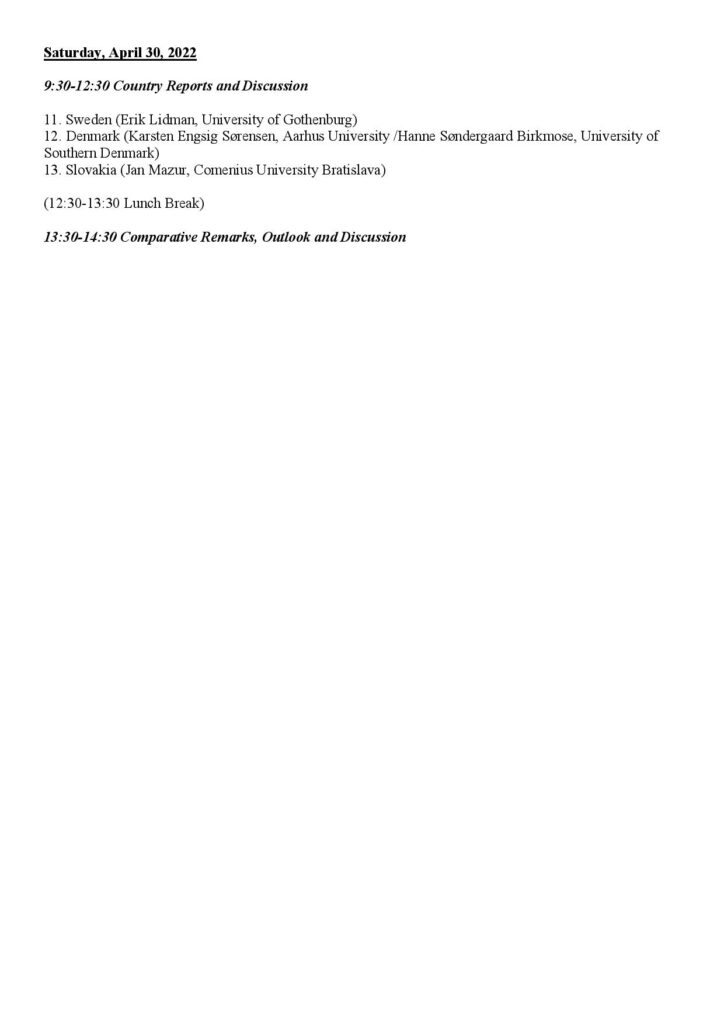

On April 29-30 2022, a conference on “Sustainable Finance in European Jurisdictions” was held at the Hungarian Academy of Sciences. Initiators were Prof. Dr. Jens Ekkenga (Justus Liebig University Giessen) and Prof. Dr. Martin Winner (WU Vienna); host was the Ferenc Mádl Institute of Comparative Law (represented by Prof. Dr. Emőd Veress). The aim of the conference was a comparative analysis of the effects of the accounting and capital market regulations of the EU Commission’s “Green New Deal” on the laws of the member states. The main question was: Are these regulations suitable for steering capital flows in such a way that a “sustainability impact” (in the sense of the ESG doctrine) is also achieved in the real economy? Renowned representatives from 14 member states were invited to present their country reports; Prof. Dr. Pierre-Henri Conac (Max Planck Institute Luxembourg) also gave a keynote speech, which provided an overview of the European regulations and their potential for further development.

The range of topics covered by the country reports was initially delineated by European law. Thematically, the reports dealt with several major blocks: (1) Sustainable Ownership or Shareholder Governance; (2) Sustainable Fund Governance; (3) Sustainable Product Governance; (4) Sustainable Financial Services Governance (on the terminology, see Ekkenga, WM 2020, 1664 ff.). Similar problems were identified throughout. For example, the regulations examined all encourage vertical and horizontal cooperation, which raises the question of whether “stewardship” practices at shareholder level might not give rise to the risk of “acting in concert” and thus even a mandatory bid under takeover law. The concept of influence via the use of voting rights is not suited to the power relations within a group of companies. Dangers to competition among the portfolio companies with completely unresolved antitrust implications were also widely identified – an assessment that also seems to be shared by the German Monopolies Commission. In addition, the trend toward “labeling” to simplify sustainability reporting was viewed critically in various quarters, particularly due to possible conflicts of interest on the part of private “labeling service providers”. In connection with this, the problem of “green washing” practices was emphasized throughout – but also that neither the European nor the national legislators seem to have a satisfactory answer.

The comparative approach of the conference, however, also led to interesting differences in addition to such diagnosed commonalities: Very fundamental differences arise primarily from the different real structures of the economies concerned, roughly speaking above all between “larger” and “smaller” economies. The latter not only have a much smaller number of directly affected companies (because they are listed on the stock exchange), but also often lack the administrative resources to implement the European requirements in a targeted manner. As a result, certain issues that are the subject of lively debate in larger countries such as Germany, France, Italy or Spain do not arise from the outset in “smaller” member states. Conversely, rooms for debate are opening up that have received little attention in “larger” member states. They concern, for example, the indirect influence of ESG regulation of listed parent companies on non-listed subsidiaries. Other issues have been identified that, for the time being, remain completely beyond research: for example, the role of banks in the context of “ESG credit covenants”, where a problem already lies in the fact that empirical data are difficult to collect. How to deal with “hybrid forms” such as the listed Stock Corporation majority-owned by non-listed shareholders also remained an open question.